Transactions are recorded using the accrual basis of accounting, where the recognition of revenues and expenses arises when earned or used, respectively. If this assumption is not true, a business should instead use the cash basis of accounting to develop financial statements that are based on cash flows. The latter approach will not result in financial statements that can be audited. how is this sales agreement recognized in the financial statements?

It can often be useful to follow the guide of an invoicing software such as Debitoor to ensure that your accounting is efficient and in order. Accountants use going concern principles to decide what types of reporting should appear on financial statements. Companies that are a going concern may defer reporting long-term assets at current value or liquidating value, but rather at cost.

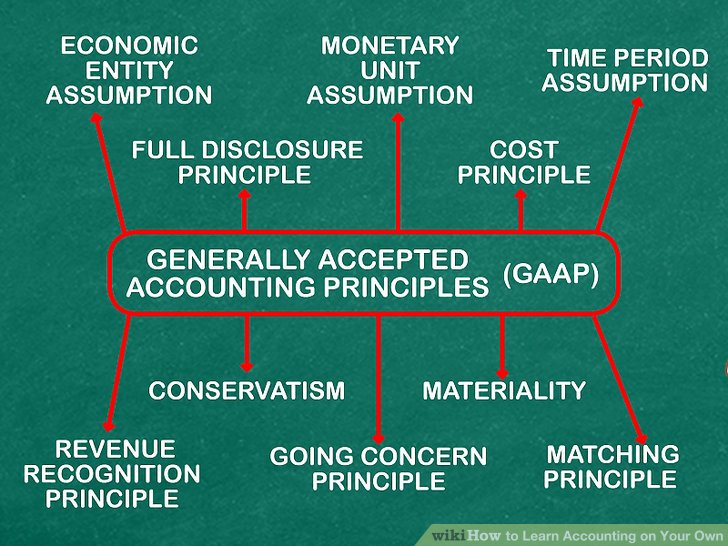

All accountants make key conceptual assumptions when reporting financial information. Because many of these assumptions are necessary for financial statements to have value, it is usually best to understand and review them when considering financial documents.

A company remains a going concern when the sale of assets does not impair its ability to continue operation, such as the closure of a small branch office that reassigns the employees to other departments within the company. Consequently, each company should develop the ability to determine which items are material relative to its operations and then engage enough employee cost to ensure adherence to accounting principles for those items.

Among the various conceptual assumptions that underlie modern accounting is the stable monetary unit concept. In general, an auditor examines a company’s financial statements to see if it can continue as a going concern for one year following the time of an audit.

Monetary Unit Assumption: Definition & Examples

A monetary asset is an asset whose value is stated in or convertible into a fixed amount of cash. Thus, $50,000 of cash now will still be considered $50,000 of cash one year from now. Examples of monetary assets are cash, investments, accounts receivable, and notes receivable. The term can be more tightly defined to exclude any assets that cannot be readily converted into cash (such as long-term investments or notes receivable).

Why is monetary unit assumption important?

Definition: The monetary unit concept is an accounting principle that assumes business transactions or events can be measured and expressed in terms of monetary units and the monetary units are stable and dependable. In other words, the language of business and finance is money.

BUSINESS IDEAS

Though the stable monetary unit assumption makes the process of accounting more manageable, it can sometimes present problems. If the value of money rapidly changes due to market conditions or the effects of policy, a business’s financial statements may be less useful for comparison with prior records. If the values of accounts or past statements are not subsequently adjusted to address the inflation or deflation, the accounting record may not accurately represent a business’s financial performance. This issue presents a link between day-to-day accounting practice and broader market trends or government policy.

Because of this assumption, past financial statements are usually not updated even if the value of money substantially changes. The concept is generally a practical necessity, even though the assumption can present some serious challenges if the currency is either deflating or inflating quickly.

In other words, the accountants believe that the company will not liquidate in the near future. This assumption also provides some justification for accountants to follow the cost principle. As these examples demonstrate, materiality is a relative concept. In practice, auditors must evaluate a material misstatement on a standalone basis and within context of a company’s financial statements overall. What constitutes a material misstatement for one company may not reach the materiality threshold for another.

- If the value of money rapidly changes due to market conditions or the effects of policy, a business’s financial statements may be less useful for comparison with prior records.

- Though the stable monetary unit assumption makes the process of accounting more manageable, it can sometimes present problems.

- If the values of accounts or past statements are not subsequently adjusted to address the inflation or deflation, the accounting record may not accurately represent a business’s financial performance.

What Does Monetary Unit Assumption Mean?

The monetary unit principle simply applies to the monetary expression of economic events, and business transactions. One of the generally accepted accounting principles is the monetary unit principle. The monetary unit principle states that business transactions should only be recorded if they can be expressed in terms of a currency. In other words, anything that is non-quantifiable should not be recorded a business’ financial accounts. Certain red flags may appear on financial statements of publicly traded companies that may indicate a business will not be a going concern in the future.

All monetary assets are considered to be current assets, and are reported as such on a company’s balance sheet. The stable monetary unit concept assumes that the value of the dollar is stable over time. This concept essentially allows accountants to disregard the effect of inflation — a decrease, in terms of real goods, of what a dollar can purchase.

The company’s characteristics, the prevailing economic and political environment and the role of the reviewer of the financial statements may each impact the materiality judgments. However, if the cost of adherence to the accounting principles seems to exceed the foreseen benefit of doing it, then a company might do away with the principles. As per the materiality concept, a company is obligated to account for such substantial amounts in a way that complies with the financial accounting principles. However, materiality is measured in terms of dollar amount and the consequence of the misstatement of such results if the accounting principles are not followed.

What is meant by the concept of stable monetary unit?

While the monetary unit assumption provides a stable basis upon which to value transactions, there are two important limitations: inflation and handling items which are difficult to quantify. The monetary unit assumption does not provide for differences in the value of a dollar due to the passage of time.

Listing of long-term assets normally does not appear in a company’s quarterly statements or as a line item on balance sheets. Listing the value of long-term assets may indicate a company plans to sell these assets. The monetary unit principle is one of the accounting principles which is universally recognised, as a communication of financial information. It is important that you comply with these principles when recording the financial activities of your business.

However, this does not mean that such fundamental accounting principles have to be compulsorily followed by all organizations. It is absolutely acceptable if the entity does not follow such assumptions while recording their financial transactions. If these fundamental assumptions have not been followed then the entity should specifically disclose this information, along with their financial statements. An accounting guideline which allows the readers of financial statements to assume that the company will continue on long enough to carry out its objectives and commitments.

Over time, money has been adopted as a measurement unit in accounting. According to the monetary unit principle, when business transactions or events occur, they are first converted into money, and then recorded in the financial accounts of a business. One of the assumptions of the monetary unit principle is that the value of the unit of currency (in which you are working with) is stable. This means that in everyday use, the monetary unit allows accountants to treat financial accounts of a business which have been recorded from different financial periods, as if they were the same. This principle therefore does not consider the concept of inflation.

Do you have any assets or liabilities resulting from this agreement recognized in the balance sheet? Because, in most simple cases, there’s nothing recognized and as a result, there’s no monetary or non-monetary item. The income statement provides information on the results of operations (net income or earnings) for a period of time. Financial position refers to the resources or assets of a business and how those assets have been financed. The balance sheet provides this information as of a point in time, typically at the end of an accounting period.

Materiality is a matter of professional judgment and your audit team’s experience. Contact us for more information on what’s considered material for your business. A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owner’s equity at a particular point in time. In other words, the balance sheet illustrates your business’s net worth. Doing so will require that new financial statements be produced that reflect the corrected assumptions.