Choose an advisor who “gets” early-stage, Silicon Valley-style businesses. The burn rate is how much money you are spending every month. The cash-out date is the estimated date you’ll be in business until given your monthly spend and the remainder of the investment you have sitting in your bank account. Scaling a startup is hard work – but scaling financial and HR backend systems shouldn’t be. The best startup accountants have worked with multiple high-growth companies, and know which software and systems are ready for hyper growth.

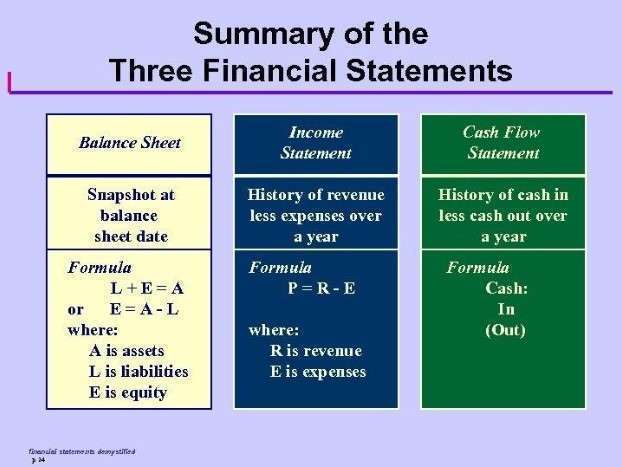

You need a startup accounting expert to support you through processes like this. Again, if you use accounting software, it will automatically create these financial statements from your general ledger entries. Cash basis accounting works well for small startups with cash transactions and no inventory.

What they usually aren’t is an experienced bookkeeper or accountant. But properly tracking your financial transactions is part of being a business owner, whether you’re a startup or an established business owner. Accounts payable (AP) is the money your business owes to its vendors for providing goods or services to you on credit. Different vendors have different payment terms, so you should use this to your advantage.

In this case, you may want to consider managing your business’s books yourself. Read more here about which accounting method is right for your startup. Founders, she says, should be focused on building the product, building the team and getting money in the bank.

Startup Budget Template

That’s why bookkeeping and accounting are so important, particularly for startups. Read about some of our expertise on our tech startup industry page. Startup accountants and CPAs are a special breed of advisors. Whereas a traditional small business focuses on their bank account balance, startups focus on the KPIs that help them raise their next round of funding.

- Read our explanation of how to pick the best accounting software for startups.

- You’ll want to find out why and make business decisions based on your findings.

- Soon after, he hired a former colleague as his third employee and director of finance.

Your accountant should function as a partner, who supports the success of your startup and helps your company achieve its goals. For more information about the value of accounting services for your startup, contact us. Read our explanation of how to pick the best accounting software for startups. Remember, VC-backed companies have different needs than traditional small businesses or solo entrepreneurs. Beyond just completing your regular tax returns, you will want to look at available tax credits, like the research & development tax credit.

How to Manage Startup Accounting

Aside from the fact that you’re saving money at a point when you don’t have much to spend, managing the books yourself gives you a grounding in basic financial concepts. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. If the word “never” comes to mind, you may want to skip this part.

If you’re still on the fence about handling basic bookkeeping or accounting for your business, you’re not alone. If the thought of doing your books is overwhelming, you have plenty of other options including enlisting the help of a CPA. You can also hire an experienced bookkeeper or accountant for your business, or just outsource the entire process. Startup CEOs and founders don’t have time to proof their books, nor should they have to. We are familiar with early-stage companies’ business models, we understand the complexities (and importance) of issues like revenue recognition, ARR, capitalized vs. non-capitalized development costs and, more.

- We’ve put together the ultimate finance and HR due diligence checklist for startups.

- Maintaining accurate accounts will ensure your startup’s financial health, stability, and growth.

- Even if you go with a sole proprietorship, you’ll still need to keep your personal and business finances separate.

- That longevity was in Woock’s mind when he hired his former colleague as head of finance.

It’s useful for small businesses with limited financial transactions. You’ll also likely want an accountant on your side for tax time. Business taxes are much trickier than personal incomes taxes. An accountant familiar with your industry will help you pay the least amount of taxes possible and protect you from the IRS limelight.

That also makes tax calculation and filing much easier to do. Not every startup business model involves complex math, especially at the outset. But if you’re trying to build a successful, well-managed company, it’s important to have a basic understanding of finance.

Tips for self-accounting your startup

Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. As a new business, you must establish good credit with your vendors from the start. But be sure to examine each bill that comes in to make sure that it’s accurate. It’s easier than you may think to pay an incorrect bill, so don’t let that happen. It is used as a proxy for cash flow while being focused on the income statement. For example, you will hear bankers, private equity investors, and those kind of folks use EBITDA as a proxy for cash flow.

This is when you take your financial model or projections and compare them every month to your actual results. For example, you compare your accounting numbers versus your projection numbers. The reason why this is so powerful is it brings a lot of scrutiny and discipline to the company. Especially as a founder, you need to know what your expectations are and how you’re doing against your expectations.

For high-growth startups, especially ones that expect to raise venture capital, management needs access to high quality financial statements. And with an already constrained time schedule, it’s easy for tight control over finances to slip away. But it’s critical that you’re comfortable with the finances supporting your business, if only so you can make strategic operational decisions as time goes on. Learning the basics, and asking for the right kind help when things go sideways, will go a long way toward getting your startup’s finances in order.

Click here to see a list of firms that might be a good fit for your business. It’s recommended to keep your financial records saved in a place that you can come back and easily reference if you ever need to. Learn more about how Ramp can make this process easier for you.

As you pick a finance professional to work with, expertise and trust are paramount. You can see that a big part of your finance person’s job will be to teach you all these variables. Soon after, he hired a former colleague as his third employee and director of finance.

What is GAAP Financials & Does Your Startup Need Them?

Tax compliance is a subset of due diligence, and your accountant can help you explain to the VC fund or the acquirer that you have followed all federal and local rules and regulations. This is becoming an increasingly important part of later-stage due diligence and M&A diligence, so make sure you have an experienced startup accounting firm if you are raising big VC $$. If you do manual accounting, you’ll need to go over every entry in your bank statement and match them with the general ledger entries. Most accounting software has features to reconcile bank statements with the general ledger entries automatically.

You can manage your startup accounting through different systems — manual, automated, or enterprise resource planning (ERP). As an added benefit, handling your own financials will allow you to truly grasp how money flows in and out of your business. You’ll feel more confident about your financial standing and the many rapid-fire financial decisions a startup founder has to make.

And if you are trying to get a business loan, you’ll need clear and easy-to-read financials so that potential investors can make an informed decision about investing in your vision. Many startups outsource their financial reporting and management functions, both to save money and to get professional accounting and finance services that would be difficult to locate and hire. As the company grows, management eventually hires the appropriate personnel and brings these financial functions in-house. However, with the current economic slowdown, some startups that may experience slower than projected growth are choosing to “re-outsource” their financials. Handling your company’s accounting is a very important duty and a full-time responsibility.