Understanding Perpetual Inventory

The costs incurred to generate revenue must be recognized in the same period in which the revenue is recognized. In that revenue is recognized at the time goods are sold, the inventory costs are simultaneously expensed. The cost of goods sold is calculated by adding the beginning inventory and purchases to obtain the cost of goods available for sale and then deducting the ending inventory. Calculating the cost of goods sold requires allocating a portion of the cost of goods available for sale to ending inventory and a portion to the cost of goods sold.

As expected, the extent to which resources generated by sales can be used to pay operating expenses and provide net income is dependent on both revenue and the cost of goods sold. Amid the ongoing LIFO vs. FIFO debate in accounting, deciding which method to use is not always easy. LIFO and FIFO are the two most common techniques used in valuing the cost of goods sold and inventory.

So technically a business can sell older products but use the recent prices of acquiring or manufacturing them in the COGS (Cost Of Goods Sold) equation. The LIFO method goes on the assumption that the most recent products in a company’s inventory have been sold first, and uses those costs in the COGS (Cost of Goods Sold) calculation. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation.

How do you know if its perpetual or periodic?

What is Perpetual Inventory? Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software. Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database. Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs.

Therefore, the $20,000 in beginning inventory is added to the $300,000 in purchases to obtain the cost of goods available for sale of $320,000. The ending inventory of $30,000 is then deducted from the $320,000 cost of goods available for sale to equal the $290,000 cost of goods sold. The perpetual inventory system controls inventory in order to both protect it from theft and damage and report it in the balance sheet as an asset that impacts net income. When the inventory is sold to customers, the inventory asset becomes an expense called cost of goods sold. The cost of goods sold represents resources expended to generate revenue.

As a result, detailed inventory records are maintained on an individual-transaction basis for both sales and purchases. As a sale is recorded, an entry is made to decrease inventory and increase the cost of goods sold. Therefore, both the ending inventory and cost of goods sold accounts reflect current balances at any point in time.

The cost of inventory directly affects both the cost of goods sold and gross margin. Generally accepted accounting principles require that the cost of goods sold be matched with the revenue generated by the sale of the inventory by means of an appropriate costing method. by Billie Nordmeyer MBA, MA Perpetual inventory systems decrease inventory and increase the cost of goods sold as sales are recorded.

Inventory is the array of finished goods or goods used in production held by a company. Inventory is classified as a current asset on a company’s balance sheet, and it serves as a buffer between manufacturing and order fulfillment. When an inventory item is sold, its carrying cost transfers to the cost of goods sold (COGS) category on the income statement. As well, the LIFO method may not actually represent the true cost a company paid for its product. This is because the LIFO method is not actually linked to the tracking of physical inventory, just inventory totals.

Cloud-based inventory management software can be a powerful tool in executing a high quality inventory system. In order to best utilize the real-time data of a perpetual inventory system, an automated and advanced system will yield the most consistent results, reducing the risk for errors.

When the retailer sells the merchandise to its customers, the retailer credits its Inventory account for the cost of the goods that were sold and debits its Cost of Goods Sold account for their cost. Rather than staying dormant as it does with the periodic method, the Inventory account balance is continuously updated.

- Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

- Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database.

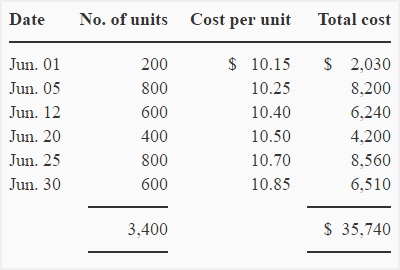

With perpetual FIFO, the first (or oldest) costs are the first moved from the Inventory account and debited to the Cost of Goods Sold account. The end result under perpetual FIFO is the same as under periodic FIFO. In other words, the first costs are the same whether you move the cost out of inventory with each sale (perpetual) or whether you wait until the year is over (periodic). In order for perpetual inventory systems to work as accurately as possible, the quality of both the system and data needs to be high.

What is accrual accounting in Oracle Apps?

If a business is small and anticipates growth, it is worth looking into switching to from a periodic system to a perpetual system. This type of inventory system requires a complex infrastructure in order to facilitate the tracking mechanisms. Perpetual inventory is often used in large businesses whereas simpler systems like periodic inventory are generally seen in smaller businesses.

COGS includes direct labor, direct materials or raw materials, and overhead costs for the production facility. Cost of goods sold is typically listed as a separate line item on the income statement.

Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made. In the latter case, this means it can be difficult to obtain a precise cost of goods sold figure prior to the end of the accounting period. The weighted average method requires valuing both inventory and the cost of goods sold based on the average cost of all materials bought during the period. Inventory is a primary revenue source classified as a current asset on the balance sheet until its sale. At this time, the inventory is classified as an expense on the income statement and is referred to as the cost of goods sold.

Under the perpetual system the Inventory account is constantly (or perpetually) changing. Rather than staying dormant as it does with the periodic method, the Inventory account balance under the perpetual average is changing whenever a purchase or sale occurs. The calculations for perpetual inventory are typically done as you go versus waiting until the end of the accounting period, like with periodic inventory.

Interest expense is one of the notable expenses not in SG&A and is listed as a separate line item on the income statement. Selling, general, and administrative expenses also consist of a company’s operating expenses that are not included in the direct costs of production or cost of goods sold. While this is typically synonymous with operating expenses, many times companies list SG&A as a separate line item on the income statement below cost of goods sold, under expenses. OPEX are not included incost of goods sold(COGS) but consist of the direct costs involved in the production of a company’s goods and services.

These inventory ledgers contain information on the item’s cost of goods sold, purchases and inventory on hand. Perpetual inventory management systems allow for a high degree of control of the company’s inventory by management. What differentiates a periodic from a perpetual inventory management system, and which makes the most sense for your company? SG&A expenses are typically the costs associated with a company’s overall overhead since they can not be directly traced to the production of a product or service. SG&A includes nearly everything that isn’t included incost of goods sold(COGS).

Businesses use one of two ways to manage inventory – periodic and perpetual. Periodic inventory management is tracked manually, counting at the end of an accounting period. Perpetual inventory is for larger businesses using point-of-sale technology. When a retailer purchases merchandise, the retailer debits its Inventory account for the cost of the merchandise.

Overall, this automated system is more accurate and accurate information can be very valuable to a business owner. It can assess if customers were responsive to discounts, their purchasing habits, and if they returned any items. Unlike periodic inventory systems, the perpetual module reduces the need for frequent, physical inventory counts.

With a real-time system updating constantly, there are many advantages to the business owner. It is a proactive way to prevent stock from running out as when stock is low it can be instantly identified and stock can be reordered. It also gives business owners a better understanding of customer buying patterns and their purchasing behavior. A more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor.

How Perpetual and Periodic Inventory Systems Work

If a company has several locations, a perpetual inventory system centralizes this management. It amalgamates all information and places it in one consolidated and accessible place.

The selection of the inventory system determines when the cost of goods sold is calculated. For the perpetual inventory system, each sale of goods and each purchase of inventory updates inventory balances as the sale is recorded and the goods are received rather than at the end of the accounting period.