The total of the receipts and the remaining cash should always equal the amount you started with. For example, if you have a $100 petty cash fund and spend $27.52 on office supplies, your receipt for the purchase plus the remaining money in the fund will add up to $100. Managing your petty cash funds begins as soon as the first check has been cashed to create the petty cash float. For example, if you have decided on a petty cash fund for $100, your petty cash account book entry will show a debit of $100 to your petty cash fund and a credit of $100 to your bank account.

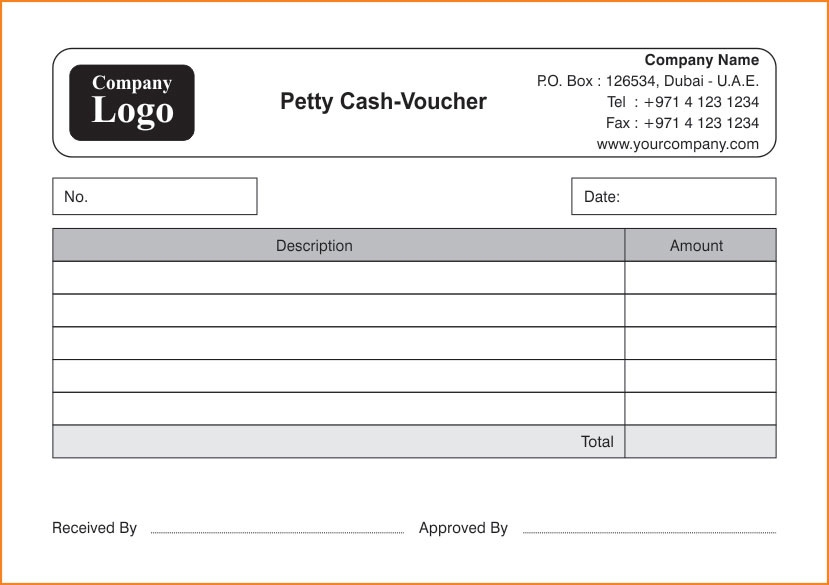

How do I write a petty cash voucher?

A petty cash voucher is usually a small form that is used to document a disbursement (payment) from a petty cash fund. Petty cash vouchers are also referred to as petty cash receipts and can be purchased from office supply stores.

You will also need to set up a petty cash account in the asset section of your financial reports. If there’s a shortage or overage, a journal line entry is recorded to an over/short account. If the petty cash fund is over, a credit is entered to represent a gain. If the petty cash fund is short, a debit is entered to represent a loss.

When a petty cash fund is in use, petty cash transactions are still recorded on financial statements. The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash. A petty cash fund is a small amount of cash kept on hand to pay for minor expenses, such as office supplies or reimbursements. A petty cash fund will undergo periodic reconciliations, with transactions also recorded on the financial statements.

AccountingTools

To replenish the fund, write a company check to “Petty Cash,” cash it and add the money to the box. The receipts and petty cash reconciliation sheet go to the bookkeeper for entry into the accounting system. When the fund requires more cash or at the end of an accounting period, the petty cash custodian requests a check for the difference between the cash on hand and the total assigned to the fund.

The petty cash custodian is charged with distributing the cash and collecting receipts for all purchases or any uses of the funds. As the petty cash total declines, the receipts should increase and tie out to the total amount withdrawn. The petty cash fund is reconciled periodically to verify that the balance of the fund is correct.

Most companies keep a small amount of cash on hand to pay minor business-related expenses that don’t warrant the writing of a check or use of the corporate credit card. A petty cash fund is a convenient method to pay for small business transactions such as postage, delivery fees or emergency office supplies. It is important to keep accurate records of all petty cash expenditures for bookkeeping purposes.

At this time, the person who provides cash to the custodian should examine the vouchers to verify their legitimacy. The transaction that replenishes the petty cash fund is recorded with a compound entry that debits all relevant asset or expense accounts and credits cash. Consider the journal entry below, which is made after the custodian requests $130 to replenish the petty cash fund and submits vouchers that fall into one of three categories. While some retail businesses run small expenses out of their tills, a proper petty cash system means setting aside a fixed amount of money in a box or drawer and using it to pay for small expenses. The receipts for the expenses go into the box along with any change from the transactions.

To initially fund a petty cash account, the accountant should write a check made out to “Petty Cash” for the desired amount of cash to keep on hand and then cash the check at the company’s bank. The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account. When petty cash is used for business expenses, the appropriate expense account — such as office supplies or employee reimbursement — should be expensed.

Voucher Check

What is the difference between cash voucher and petty cash voucher?

A cash voucher is a standard form used to document a petty cash payment. The petty cash custodian uses the cash voucher to reconcile the petty cash fund. By adding together all on-hand cash with the amounts stated on the cash vouchers, the total should equal the designated cash total for the petty cash fund.

Companies assign responsibility for the petty cash fund to a person called the petty cash custodian or petty cashier. To establish a petty cash fund, someone must write a check to the petty cash custodian, who cashes the check and keeps the money in a locked file or cash box. The journal entry to record the creation of a petty cash fund appears below. If the custodian finds that the petty cash fund is too small—this is the case if the fund needs replenishing every few days—then he or she may increase the float. On the other hand, the custodian may find that the fund amount is excessive.

The petty cash fund is an effective way to manage smaller expenses in the office without having to submit a formal requisition every time. By keeping a small amount of cash on hand, you can make purchases as necessary and submit the receipts. Proper tracking and reconciliation is essential to managing the petty cash balance. Reconcile the balance compared to the activity at the end of each accounting period, or more often if your petty cash fund has more frequent activity. A cash voucher is a standard form used to document a petty cash payment.

Typically, as the petty cash balance falls to a preset level, the custodian applies for additional cash from the cashier. At this time, the total of all of the receipts is calculated to ensure that it matches the disbursed funds from the petty cash drawer. If new funds are needed, the cashier writes a new check to fund the petty cash drawer and takes, in exchange, the receipts from the purchases that depleted the cash.

- When a petty cash fund is in use, petty cash transactions are still recorded on financial statements.

In this case, the surplus petty cash should be taken from the fund and deposited in the company bank account. When the check is cashed, the funds will be added to petty cash so that its original level is restored.

That’s a long way of saying it’s “shoebox money” for expenses which are usually too small to bother using a credit card or writing a check. Petty cash is a system that funds and tracks small purchases such as parking meter fees that aren’t suitable for check or credit card payments. A petty cash book is a ledger kept with the petty cash fund to record amounts that are added to or subtracted from its balance. Petty cash should be part of an overall business accounting system that documents how your business moves funds between one account and another and how it spends its money. A petty cashier might be assigned to issue the check to fund the petty cash drawer and make the appropriate accounting entries.

There might be a petty cash fund, which can be a drawer or box, in each department for larger corporations. The IRS requires receipts for all expenses over $75, but it is a good habit to get receipts for every petty cash transaction, no matter how small. The receipts will provide the backup to the petty cash replenishment checks when you need to top up the fund. When petty cash gets low, always check the balance with receipts before adding more.

Examples of these payments are office supplies, cards, flowers, and so forth. Petty cash is stored in a petty cash drawer or box near where it is most needed. There may be several petty cash locations in a larger business, probably one per building or even one per department. A separate accounting system is used to track petty cash transactions.

What is a petty cash voucher?

A petty cash fund is generally kept so that employees of a business can make small purchases without having to requisition money, use a company credit or debit card, or have a check cut. These types of transactions require more time and paperwork to complete. Petty cash is a current asset and should be listed as a debit on the company balance sheet.

The amount listed in the petty cash account is almost always overstated, since the various petty cash custodians are always disbursing petty cash in exchange for receipts for expenses incurred. Consequently, petty cash balances are rarely updated just to improve the accuracy of the financial statements. The custodian is responsible for keeping the petty cash funds in a safe place such as a lockable box only to be accessed when needed. When the custodian disburses money from the petty cash fund, he or she will write out a petty cash receipt which will be signed by the employee who is receiving the funds. The receipt will also show the amount disbursed and what the fund is being used to purchase.

This takes the form of a summarization of all the receipts that the custodian has accumulated. The cashier creates a new check in the amount of the receipts, and swaps the check for the receipts. The petty cash journal entry is a debit to the petty cash account and a credit to the cash account. Petty cash replenishment occurs when funds are added to a petty cash box in an amount sufficient to bring the cash balance of the cash box back up to its designated balance. Replenishment is required periodically, as cash payments from the petty cash box are used to pay for incidental expenses.

You can set up your petty cash float – the maximum, fixed amount of on-hand cash – by cashing a check, usually ranging from $100 to $500 depending on the size of your business. The amount you select for your petty cash fund must be sufficient to cover small expenses over a designated period, usually one month.

The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. The cashier creates a journal entry to record the petty cash receipts. This is a credit to the petty cash account, and probably debits to several different expense accounts, such as the office supplies account (depending upon what was purchased with the cash). The balance in the petty cash account should now be the same as the amount at which it started. Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs.

The purpose of a petty cash fund is to provide business units with sufficient cash to cover minor expenditures. The intent is to simplify the reimbursement of staff members and visitors for small expenses that generally do not Exceed $25.00, such as taxi fares, postage, office supplies, etc.

Typically, one employee is responsible for controlling petty cash funds. The custodian will maintain and document all expenses from the petty cash. By giving this responsibility to one custodian, it means that you will retain internal control over the money. A petty cash reconciliation is a formal review of petty cash records. The intent of this activity is to see if there have been any undocumented disbursements.

A petty cash system helps businesses pay small expenses quickly without recording each transaction. It is a separate fund of cash that is set aside to pay for supplies or other low-dollar expenses. To control the petty cash fund properly and record it correctly for tax purposes, the fund should be stored in a secure location and reconciled frequently.

Companies normally use checks to pay their obligations because checks provide a record of each payment. Companies also maintain a petty cash fund to pay for small, miscellaneous expenditures such as stamps, small delivery charges, or emergency supplies. The size of a petty cash fund varies depending on the needs of the business. For this reason, companies typically establish a petty cash fund that needs to be replenished every two to four weeks.

Managing Receipts

The over or short account is used to force-balance the fund upon reconciliation. The petty cash account should be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for. The accountant should write a check made out to “Petty Cash” for the amount of expenses paid for with the petty cash that month to bring the account back up to the original amount. The check should be cashed at the company’s bank and the cash placed back in the petty cash safe or lock box. When the cash balance in the petty cash fund drops to a sufficiently minimal level, the petty cash custodian applies for more cash from the cashier.